Asia has been the biggest region for solar demand since 2013 and will continue to be so for the foreseeable future. The Asia-Pacific region is set to install 55 percent of all the world’s new PV in the next five years.

Cumulative solar inverter capacity in Asia-Pacific, including Australia, will increase by 60 percent, from 222 gigawatts in 2017 to 578 gigawatts in 2023. China, India and Japan together will account for 78 percent of this capacity increase.

Asian demand is largely driven by China, which, despite policy brakes, saw a stronger-than-expected installation rate of 33 gigawatts from January to August 2018. A move to auctions is expected to reduce Chinese solar demand in 2019.

But China is aiming to increase its non-hydro renewable energy quota from 9.4 percent in 2018 to 11.9 percent in 2020, a target that Wood Mackenzie expects will be met comfortably and help drive solar deployments.

Another major Asian market for solar is India, which is expected to surpass 25 gigawatts of cumulative capacity in 2018.

India has imposed a 25 percent safeguard duty on solar modules that will drop to to 15 percent by solar damper 2020, but may reduce demand by 2 gigawatts through to 2020.

Duties and Photovoltaic holder auction cancellations are forecast to make India miss an upcoming target of 100 gigawatts of solar by 2022. Even with these reductions, Asian solar demand is expected to remain far ahead of any other region.

China, Japan and India will make up 20 percent of the total global solar market through to 2023, according to Wood Mackenzie. And over the next two years, China and Japan will make up half of annual installations,solar inverter even though both markets are in decline.

In the short term, most of the remaining demand is expected to be split between Europe and North America, which will account solar slewing drive for 28 percent of the market by 2023. Europe is on course to install more than 10 gigawatts of solar capacity in 2018, the highest level since 2013.

Germany will solar damper remain the continent’s largest market solar slewing drive up to 2020, installing 24 percent of Europe’s total PV during this period.

Beyond 2020, France, the Netherlands, Italy and Spain will all come close to matching Germany, with a combination of competitive auction-based procurement and a transition toward subsidy-free PV fostering growth in utility-scale solar.

Finally, in North America U.S. utility solar has grown significantly. The market has seen 8.5 gigawatts of projects announced the first half of 2018.

This compares to a cumulative 10.6 gigawatts of solar installed across the country in 2017, based on U.S. Solar Market Insight 2017 Year in Review data from GTM Research and the Solar Energy Industries Association.

U.S. installations in 2017 were significantly down from the 15 gigawatts installed in 2016, but still represented 40 percent growth over the installation total in 2015.

The forecast growth solar damper in solar worldwide will not be enough to meet global climate goals, according to various authorities. Solar and wind now make solar tracker actuator up 7 percent of the global power market, Wood Mackenzie says.

But to achieve the United Nations Intergovernmental Panel on Climate Change’s mid-range pathways to keep temperatures from rising less than 1.5 degrees Celsius would require renewables to provide 70 to 85 percent of electricity by 2050.

And the International Energy Agency’s 2018 World Energy Outlook sustainable development scenario envisages wind and PV generation would have to grow from 1.5 petawatt-hours a year in 2017 to 14.1 petawatt-hours in 2040 to achieve the objectives of the solar tracker actuator Paris Agreement.

Reaching the levels of solar installation required for climate change mitigation will be highly dependent on module pricing, which Wood Mackenzie estimates could drop to a global average of 67 cents per watt by the end of 2023.

It will also likely depend on the growth of solar-plus-storage. This is already taking off in the U.S., where 2.5 gigawatts of hybrid storage was in operation, under solar tracker actuator construction or announced solar slewing drive in 2018

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

who are the leaders in solar trackers for the power industry?

who are the leaders in solar trackers for the power industry?

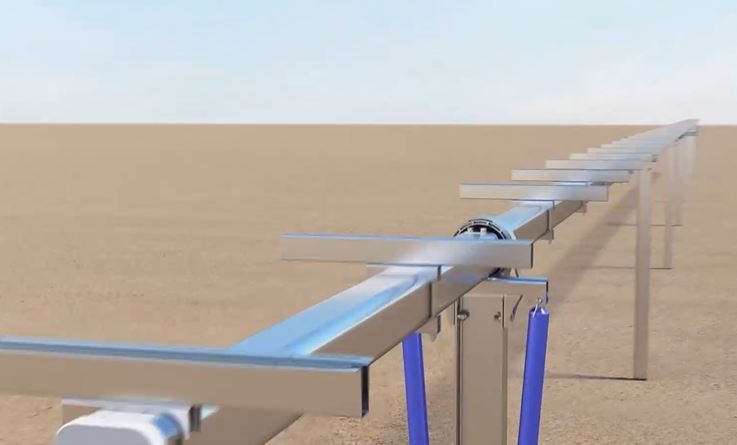

Trina releases new version of Vanguard 1P solar tracker

Trina releases new version of Vanguard 1P solar tracker

GameChange Solar Tests Tracking System for 40-Year Lifespan

GameChange Solar Tests Tracking System for 40-Year Lifespan